You are here:Chùa Bình Long – Phan Thiết > crypto

When to Sell Bitcoin on Cash App: A Comprehensive Guide

Chùa Bình Long – Phan Thiết2024-09-22 03:40:41【crypto】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized cryptocurrency, has gained immense popularity over the year airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized cryptocurrency, has gained immense popularity over the year

Bitcoin, the world's first decentralized cryptocurrency, has gained immense popularity over the years. As more people invest in this digital asset, the need for a reliable platform to buy, sell, and manage their Bitcoin has become crucial. One such platform is Cash App, which offers a user-friendly interface and a seamless experience for Bitcoin transactions. However, deciding when to sell Bitcoin on Cash App can be a challenging task. In this article, we will discuss the factors to consider when determining the right time to sell your Bitcoin on Cash App.

1. Market Trends

The cryptocurrency market is highly volatile, and Bitcoin's price can fluctuate significantly within a short period. To make an informed decision, it is essential to keep an eye on market trends. Here are a few indicators to consider:

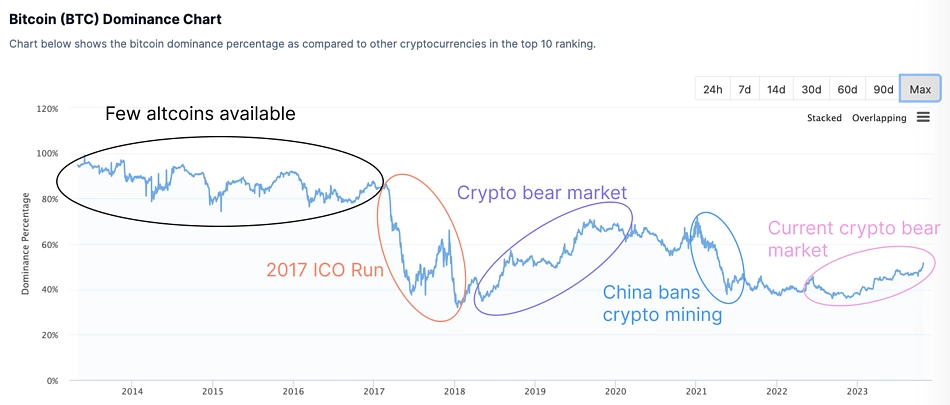

a. Historical Data: Analyzing historical price charts can help you identify patterns and trends. If Bitcoin's price has been on an upward trend, it might be a good time to sell.

b. Market Sentiment: Sentiment analysis involves studying the mood of the market. If there is a general consensus that Bitcoin's price will rise, it might be wise to hold onto your Bitcoin. Conversely, if the sentiment is bearish, selling might be a prudent move.

c. News and Events: Stay updated with the latest news and events that can impact the cryptocurrency market. For instance, regulatory news, technological advancements, or major partnerships can significantly influence Bitcoin's price.

2. Your Financial Goals

Before deciding to sell Bitcoin on Cash App, assess your financial goals. Ask yourself the following questions:

a. Am I selling Bitcoin to meet an immediate financial need?

b. Do I have a specific target price in mind?

c. Am I selling Bitcoin as part of a long-term investment strategy?

Understanding your financial goals will help you determine the right time to sell your Bitcoin.

3. Risk Management

Risk management is crucial when dealing with volatile assets like Bitcoin. Here are a few risk management strategies to consider:

a. Stop-Loss Orders: Set a stop-loss order to automatically sell your Bitcoin if its price falls below a certain level. This will help you minimize potential losses.

b. Diversification: Don't keep all your investments in Bitcoin. Diversify your portfolio by investing in other assets, such as stocks, bonds, or real estate.

c. Regular Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation. This will help you manage risk and avoid overexposure to Bitcoin.

4. Tax Considerations

When selling Bitcoin on Cash App, it is essential to consider the tax implications. Here are a few key points to keep in mind:

a. Capital Gains Tax: If you sell Bitcoin at a profit, you may be subject to capital gains tax. The tax rate depends on your country's tax laws and your income level.

b. Reporting Requirements: Ensure that you report your Bitcoin transactions accurately to avoid any legal issues.

5. Trust Your Instincts

Lastly, trust your instincts. If you feel that the time is right to sell Bitcoin on Cash App, don't hesitate. However, if you are unsure, it might be better to wait and gather more information.

In conclusion, deciding when to sell Bitcoin on Cash App requires careful consideration of market trends, financial goals, risk management, and tax implications. By staying informed and following these guidelines, you can make a well-informed decision that aligns with your investment strategy. Remember, timing the market is challenging, but with the right approach, you can maximize your returns and minimize potential losses.

This article address:https://www.binhlongphanthiet.com/btc/65b60199333.html

Like!(5348)

Related Posts

- Binance Bake Coin: A New Era of Crypto Innovation

- The Importance of Real-Time Bitcoin Price Tracking

- Bitcoin Core Wallet Location: A Comprehensive Guide

- Can You Pay Bills with Bitcoin?

- How to Withdraw USDT from Binance: A Step-by-Step Guide

- Can You Pay Bills with Bitcoin?

- Unlocking the Potential of Bitcoin on Binance: A Comprehensive Guide

- How to Withdraw from Binance Without Verification: A Step-by-Step Guide

- What is Causing Bitcoin Cash to Spike?

- Why Is the Price Different on CoinMarketCap to Binance?

Popular

Recent

Bitcoin Price Last 60 Days: A Comprehensive Analysis

Binance Smart Chain List of Projects: A Comprehensive Overview

How to Withdraw Money from Binance to Bank Account: A Step-by-Step Guide

Bitcoin Mining Alternative 2017: Exploring New Opportunities

Live Bitcoin Price Quotes: The Ultimate Guide to Tracking Cryptocurrency Value

Bitcoin Diamond Mining Cloud: A Game-Changing Solution for Cryptocurrency Enthusiasts

**Pyr Listing on Binance: A New Era for Cryptocurrency Investors

Is Bitcoin Cash Mined?

links

- Binance Fees: How to Buy Crypto with Minimal Costs

- Bitcoin Core Wallet Sync Time: Understanding the Process and Optimizing Your Experience

- Can You Buy Bitcoin with Credit Card on Bitfinex?

- Where Can I Buy Bitcoins in Uzbekistan: A Comprehensive Guide

- Electricity Cost Mining Bitcoin: A Comprehensive Analysis

- How to Send USDT from Binance to Trust Wallet

- Has China Approved Bitcoin Mining?

- Can I Download All of Binance's Historical Data?

- Is Binance Coin a Good Buy?

- If I Sell Bitcoin, Do I Get Cash?